In short, the answer is “no”, but it’s important to know why this topic keeps popping up.

This whole misunderstanding came about with the passing of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) that was largely heralded as a permanent fix to the annual “doc fix”, where congress would approve a spending bill that would defer a scheduled reduction of Medicare payment levels to doctors and facilities. It was seen as a huge win for our nation’s physicians, but it caused some angst for those of us working in the Medicare insurance industry. Buried deep inside MACRA was a provision that will change the landscape of the Medicare Supplement plans starting in 2020, and has created a lot of confusion not only for clients but for agents as well.

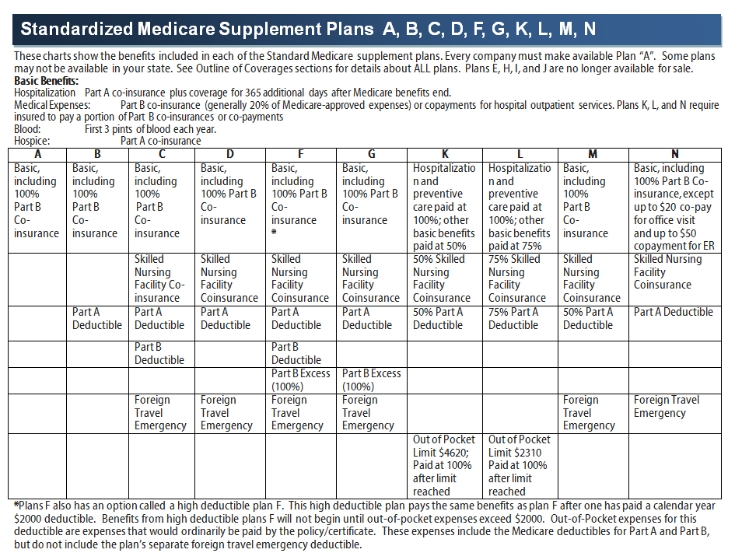

Currently, in 47 states throughout the country, we enjoy a platter of 10 modernized Medicare Supplement plan designs all indicated by a given letter; A, B, C, D, F, G, K, L, M and N. We lovingly refer to these plans as “alphabet soup” and have come to fully understand their similarities and differences when helping our clients make coverage decisions. It’s no mystery that plans F and G are the most commonly sold today, as they offer some of the most comprehensive benefits among the group. When you put these plans side by side you can see each plan has its unique advantages:

With MACRA, the grid above will be changing slightly, and it’s important to know how this will affect your current and future clients. First, and most importantly, plans C and F will not be going away, but they will be limited as to who can purchase one starting in 2020.

- Clients eligible for Medicare prior to January 1st of 2020 – all 10 Medicare Supplement plans are available to purchase

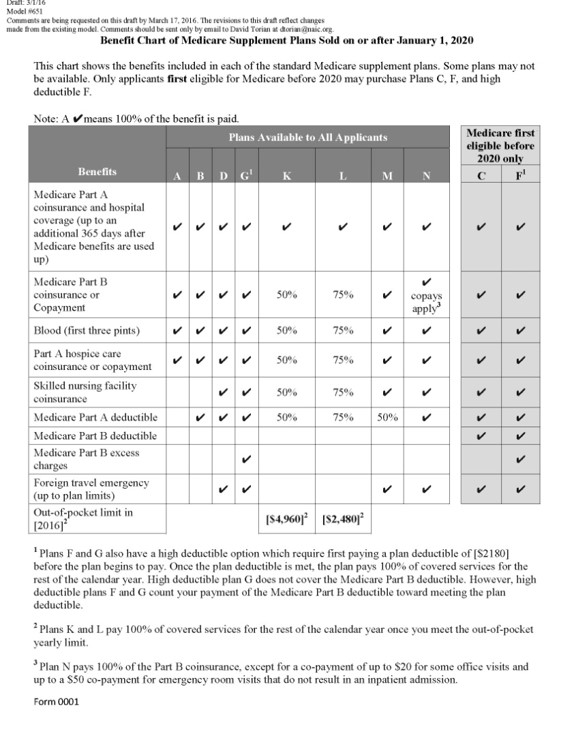

- Clients eligible for Medicare on or after January 1st of 2020 – cannot purchase a Medicare Supplement policy that covers the Part B deductible (Plans C and F) – *Section 401 of MACRA

So, clients already on Plans C and F as of 1/1/2020 can keep their plans and those already on Medicare as of 1/1/20 can continue to enroll in Plans C & F. The changes to the grid have not been finalized, but here is a proposed model to preview:

So, how will this affect our business? Other than tossing in a layer of complexity to Medicare Supplement sales, it should be smooth sailing as we venture into the 2020’s and beyond. We expect to see the overall increase in Plan G sales continue through 1/1/20 and may even see more financially savvy consumers venture into the Plan K and Plan L territory, but that’s a whole other blog post for another time.